Me-n-Ed's Pizza has served slices and sodas at its Austin Heights location for 44 years and owners Cris and Richard Florian say they hope to continue "until the bulldozers arrive."

But it may not be the wrecking ball that finally forces the longtime restaurateurs to relocate.

With real estate developers eyeing the area and a neighbourhood plan that allows for high-density residential projects, land values — and property taxes tied to the land values — have risen sharply in the last few years.

"It has created this perfect storm," said Richard Florian. "We have never minded paying our fair share of tax… but for us to bear a higher burden of tax than the rest of the community to the point where it drives us under? It is ridiculous."

BC ASSESSMENT

One of the major factors causing property taxes to soar in their neighbourhood stems from how BC Assessment values land.

Valuations are based not on what currently exists on the site but on the land's "highest and best use," which, in the case of the Me-n-Ed's Austin location, is high-density residential with a 25-storey height limit.

Further complicating the issue is the fact that most businesses in the area operate with triple-net leases — a common practice in Canada — and do not benefit from the increasing property values but are still on the hook for the property taxes.

"This method of assessment has placed an unjust and tremendous financial burden on our property and business owners," said Lisa Landry, executive director of the Austin Heights Business Improvement Association (BIA). "Many of them are now facing the very real possibility of having to relocate or close their business as they simply cannot sustain the massive property taxes they are now experiencing."

Indeed, the rising rates are taking their toll on the Florians.

Last year, their property taxes jumped from $25,000 to $44,000. With BC Assessment's latest valuations showing the land has again increased 30% to $3.8 million, they estimate they will pay between $50,000 and $55,000 to the city in 2019.

They know they will have to move when the site is eventually redeveloped but said they are frustrated with the additional taxes they have to pay in the meantime.

"Let's say it takes five years for the bulldozers to come," Richard said. "For them to make an additional $200,000 off our backs is just plain wrong."

CHANGING NEIGHBOURHOOD

Me-n-Ed's is not the only Austin Heights business struggling with increasing tax burdens as a result of rising land assessments.

A few doors down, Min Chun, whose wife owns Austin Dog Grooming, told The Tri-City News they are worried they may not be able to afford the terms when their lease comes up for renewal this year.

"We don't know if we are going to extend it or not," he said. "It is still up in the air."

Even major chains are not immune.

The McDonalds at 1131 Austin Ave. has seen some of the biggest property value increases in the neighbourhood, rising from $3 million to $8.7 million (162%) in 2017. The increase led to a jump in property taxes, which rose from $60,000 to $130,000. This year, the land value for the site increased again, up 30.3% to $11.4 million.

Business proprietors who own their property are also feeling the pinch.

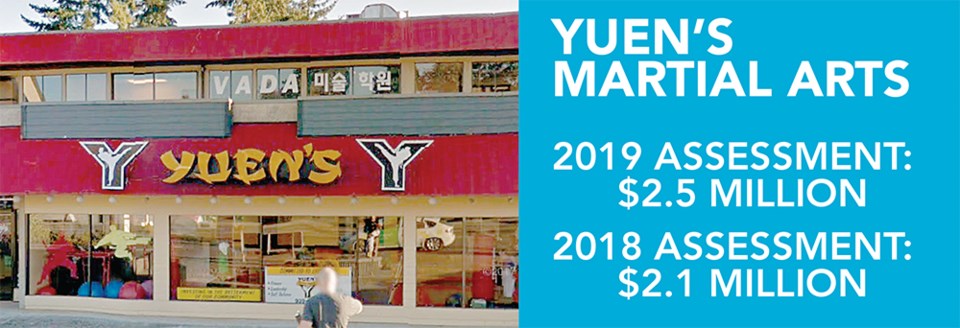

Across the street from Me-n-Ed's, Kelly Yuen, who owns Yuen's Martial Arts, has watched his assessments jump from $2.1 million last year to $2.5 million this year. As a result, he said he expects to pay more than $40,000 in property taxes and has been setting money aside each month in anticipation of the tax hit.

"It still impacts me," he said.

BIG PICTURE

The changes coming to Austin Heights are only just beginning.

Beedie Living is building 350 units in two highrise towers on the old Safeway site, a development that is expected to spur property growth in a part of Coquitlam that had previously seen little interest from real estate developers.

Owen Coomer, manager of the John B Pub and vice-president of the BIA, told The Tri-City News the neighbourhood is a microcosm of what is occurring in similar places across Metro Vancouver.

He said he worries the area will end up looking more like Metrotown or Brentwood than the Austin Heights people have come to know. Small mom-and-pop shops will likely struggle to maintain their place on the commercial strip as more redevelopment occurs, Coomer added.

"These are staples in the community," he said. "It is unfortunate that the little guys are having to be pushed out."

A NEW POLICY?

Coquitlam Mayor Richard Stewart said he is hopeful policies can be enacted quickly to ease the tax burden on small business owners.

He is in favour of split assessments, which allow the commercial component of a mixed-use development to pay a commercial rate while the residential component pays a residential rate.

"It would essentially allow the property to be valued based on its current use rather than the speculative value," Stewart said.

He called the current system "grossly unfair" but added that municipal taxes fall under the purview of the provincial government. Victoria decides how property taxes are calculated, he said, noting the city does not have the authority to "make any adjustments on a business-by-business basis."

Selina Robinson, the MLA for Coquitlam-Maillardville and the minister of municipal affairs and housing, was not made available to speak to The Tri-City News. But in an emailed statement, she said she has asked staff at the ministry to look at how property values are assessed in a rapidly rising real estate market, particularly when an area has been rezoned for higher-density use.

"This is an issue I am following closely and my ministry is continuing to look at the challenges facing those in the commercial and light industrial classes," she said in the statement. "This is a complex, but important issue for both business owners and local governments so it is important that we take the time to get it right."

More BC Assessment stories here:

• Industrial land shortage driving up prices

• Big bucks for Tri-City commercial properties

@gmckennaTC