Port Coquitlam's financial belt-tightening is an example neighbouring municipalities should look to according to the lead author of a Fraser Institute study released Thursday.

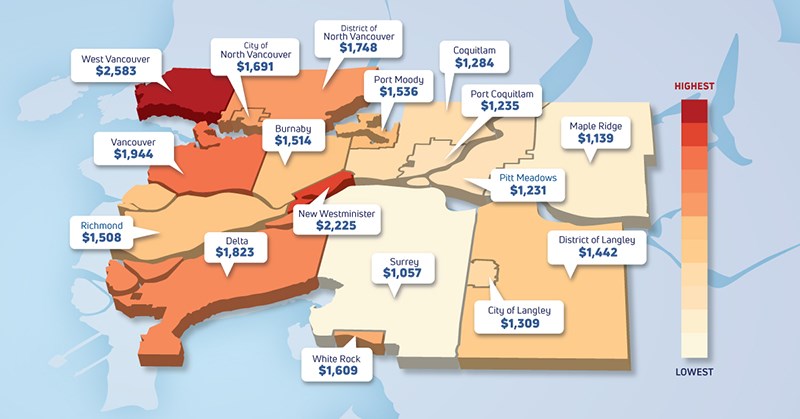

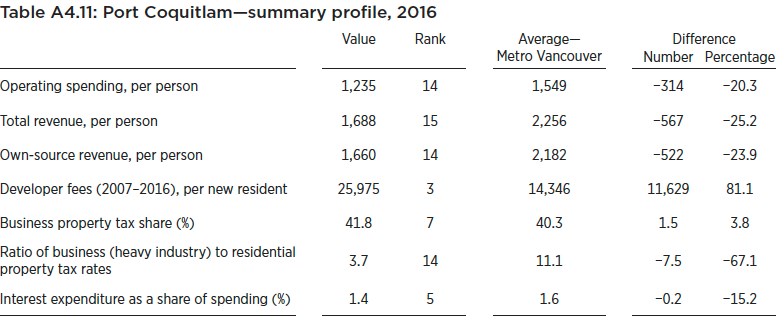

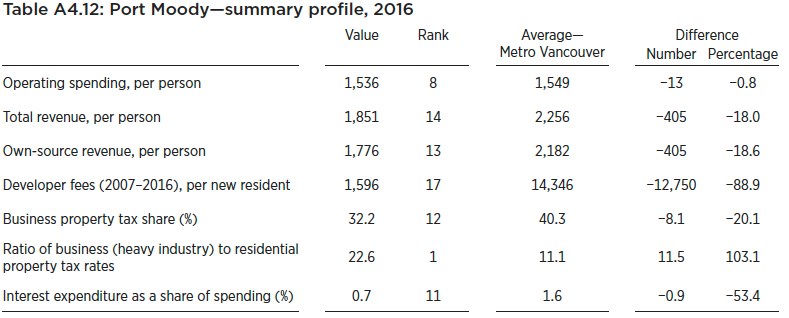

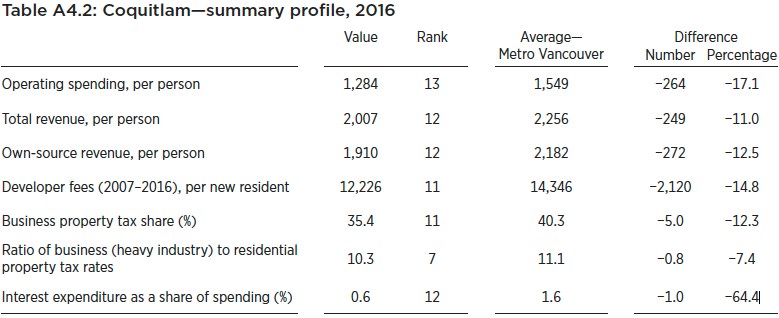

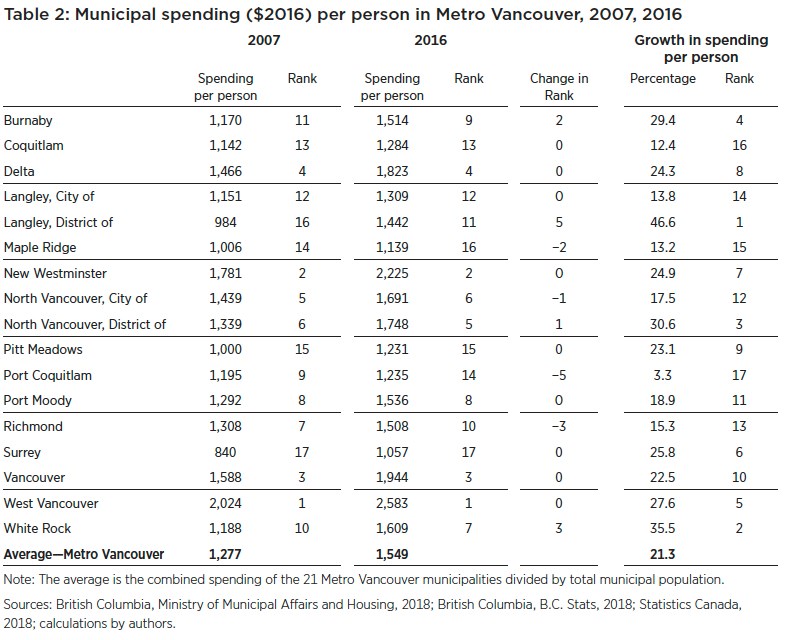

Although all 17 Metro Vancouver municipalities in the study increased their per-person spending after inflation between 2007 and 2016, PoCo had the lowest growth in its spending at 3.3%. The regional average was 21.3%. The city spent $1,235 per person in 2016 to put it 14th overall, which is a drop of six spots since 2007. Port Moody was eighth highest, the same position as it was in 2007, at $1,536 per person. Coquitlam retained its 13th place ranking from 2007 at $1,284.

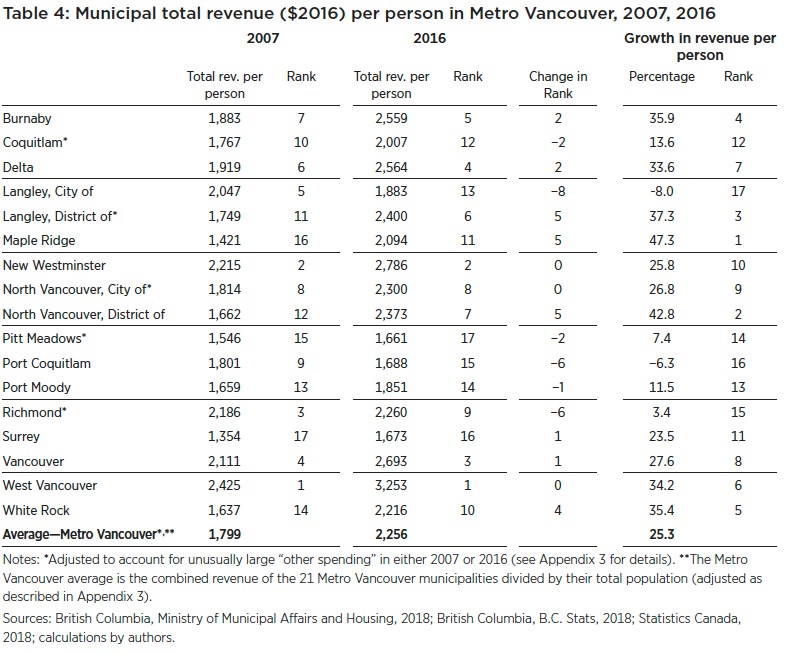

Port Coquitlam was also one of two local governments that collected less in taxes and fees, after inflation and population growth is taken into account, than it did in 2007 at –6.3%. Langley city was –8% while all the rest, except for two, had a percentage increase in the double digits.

"That was pretty unique in the region. It was quite interesting to note [Port Coquitlam] has found a way to restrain its spending. And the same can be said on the revenue side," said Fraser Institute senior planning analyst Josef Filipowicz in an interview with The Tri-City News.

"Residents from Port Coquitlam and from neighbouring municipalities might be wondering about why, and what their city hall is doing for them."

Outgoing PoCo Mayor Greg Moore said it's nice to have a third-party review recognize what the city has accomplished. Moore, who became mayor in 2008, said the city has redone its budget processing with deep dives into how to be more effective and efficient in delivering services.

Port Coquitlam relies on business property tax for 41.8% of its general tax revenue, which is seventh highest. Coquitlam is 35.4% (11th) and Port Moody 32.2% (12th). Moore said PoCo has been the beneficiary of industrial growth in the Dominion triangle and along Kingsway Avenue.

"We have over 1.6 million square feet of industrial land right now, which is the largest industrial growth that we've seen in our memory," said Moore.

General taxation, such as property tax, makes up 62.6% of Port Moody's revenue, the highest proportion in Metro Vancouver. Port Moody collected, in 2016, $1,112 per person in general tax, the fourth highest in Metro Vancouver. Coquitlam was ninth at $1,045 and Port Coquitlam 11th at $993.

Port Moody Mayor Mike Clay said there were no surprises in the study for his city noting the study shows its spending has gone up about 2% a year. PoMo's spending being higher than PoCo and Coquitlam can in large part can be attributed to having its own police force, said Clay. The four highest spenders per resident – West Vancouver, New Westminster, Vancouver and Delta – all have their own police force.

"We're usually the lowest of policing costs of [the cities] with their own police," said Clay.

Contracting the RCMP instead of having its own force is a conversation that always comes up, said Clay, but "we think we get good value for that service. Residents like the personal level of service, we have one of lowest crime rates and one of the highest clearance rates in solving crimes in the region."

Clay said Port Moody would be more conducive to the concept of a regional police force than going with the RCMP.

According to the study, Port Moody collected the lowest amount of development fees per new resident at $1,596. The highest was West Vancouver at $106,104 while Port Coquitlam was third ($25,975) and Coquitlam 12th at $12,226.

Clay said that's because most of Port Moody's large developments came before 2007. He expects an injection of development fees in the future with Onni completing the final phase of Suter Brook and the future mixed-use project slated for the land currently occupied by the Flavelle sawmill.

Coquitlam Mayor Richard Stewart didn't find anything surprising in the study.

"Much of it we've known," said Stewart. "We've been really tight with budgets in the last eight years and not withstanding senior governments that keep downloading costs onto municipalities, we've been able to keep our average tax increase this year to 2.06 per cent, which again is below average.

"[The study] can provide some information, but there are some grains of salt there … A typical resident isn't going to get a complete picture of the issues from reading this."

The report from the conservative think tank comes just eight weeks prior to municipal elections on Oct 20.

"It's a long-term study, but certainly we knew [releasing the study now] would help our report reach more people if they were in a state of mind to understand their municipality's finances compared to others," said Filipowicz.

Not included in the study were Anmore, Belcarra, Bowen Island and Tsawwassen First Nation. The reported noted since they have populations under 5,000 there are different financial arrangements with the province including not being required to offer police services.

newsroom@tricitynews.com