When it comes to financial priorities, Canadians are hoping to improve their debt next year.

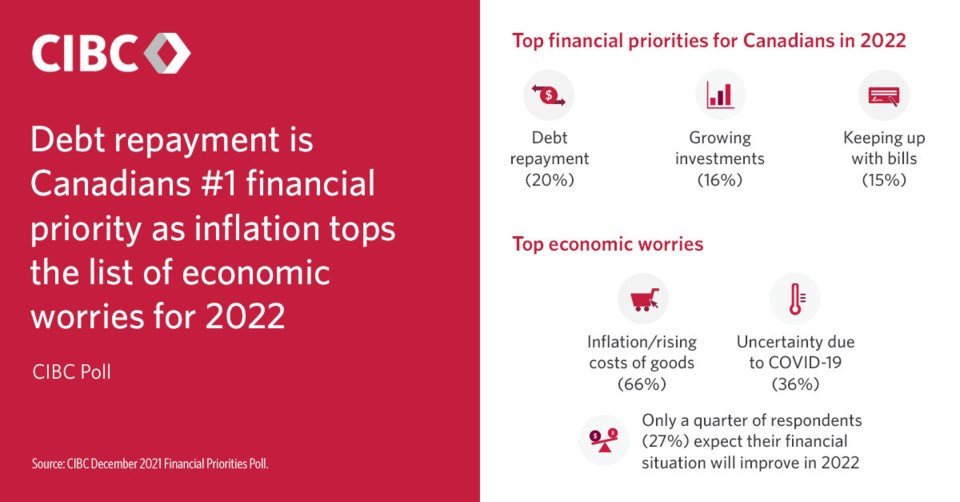

That's according to a CIBC poll, which found 20 per cent of people surveyed say debt repayment is their number one goal for 2022. That's followed by growing investments and keeping up with bills.

From Dec. 6 to Dec. 7, more than 1,500 Canadian adults were randomly selected for the questionnaire.

The poll found that 66 per cent of people are worried about inflation and 36 per cent are concerned about uncertainty due to COVID-19. Those were the top two economic worries for participants.

"It's understandable that Canadians are concerned about the economy in 2022, but what's important is to have their personal financial house in order, if goods, services and carrying debt are going to cost more," said Carissa Lucreziano, vice-president of financial and investment advice at CIBC, in a statement.

Only a quarter of respondents (27 per cent) expect their financial situation to improve next year and 37 per cent say they took on more debt in 2021 as expenses exceeded their monthly income.

"Although a number of Canadians do not feel their finances will get better in 2022, most have not had a planning session with their financial advisor in the last year. Making that a New Year's resolution can help Canadians manage their financial expectations — and any surprises — in 2022,” says Lucreziano.

When Canadians were asked about financial wellness, 47 per cent say living without financial stress was a top priority.

Lucreziano says it's imperative to seek ways to mitigate financial stress.

"Having a plan to reach your long-term ambitions and a clear understanding of your monthly cash flow can significantly reduce stress, which is why we recommend seeking the help of a financial expert who can implement a plan to alleviate these pressures and get people on track to achieve their ambitions," she adds.

Half of the people who filled out the questionnaire wished they were better at saving.